NEW ORLEANS — Hundreds of thousands of Louisiana residents filed insurance claims after two disastrous hurricane seasons, and more than 6,000 of them have lodged complaints against their insurance companies, according to the state Department of Insurance.

The American Policyholders Association and other advocates say the state of Louisiana needs to do more to protect homeowners from unfair treatment by insurers and their consultants. The APA and another insurance reform group, Real Reform Louisiana, are now backing a bill in the state Legislature by Rep. Ed Larvadain, D-Alexandria, that would create a new agency to address those claims.

“We're not seeing the level of enforcement that we need to either at the state or local level,” said the bill’s author, Real Reform Louisiana’s executive director Eric Holl.

Larvadain said the new agency, if created, would be even-handed in addressing fraud and unfair practices by both insurers and the insured, helping prevent inflated claims by policyholders while also protecting property owners from insurance underpayments.

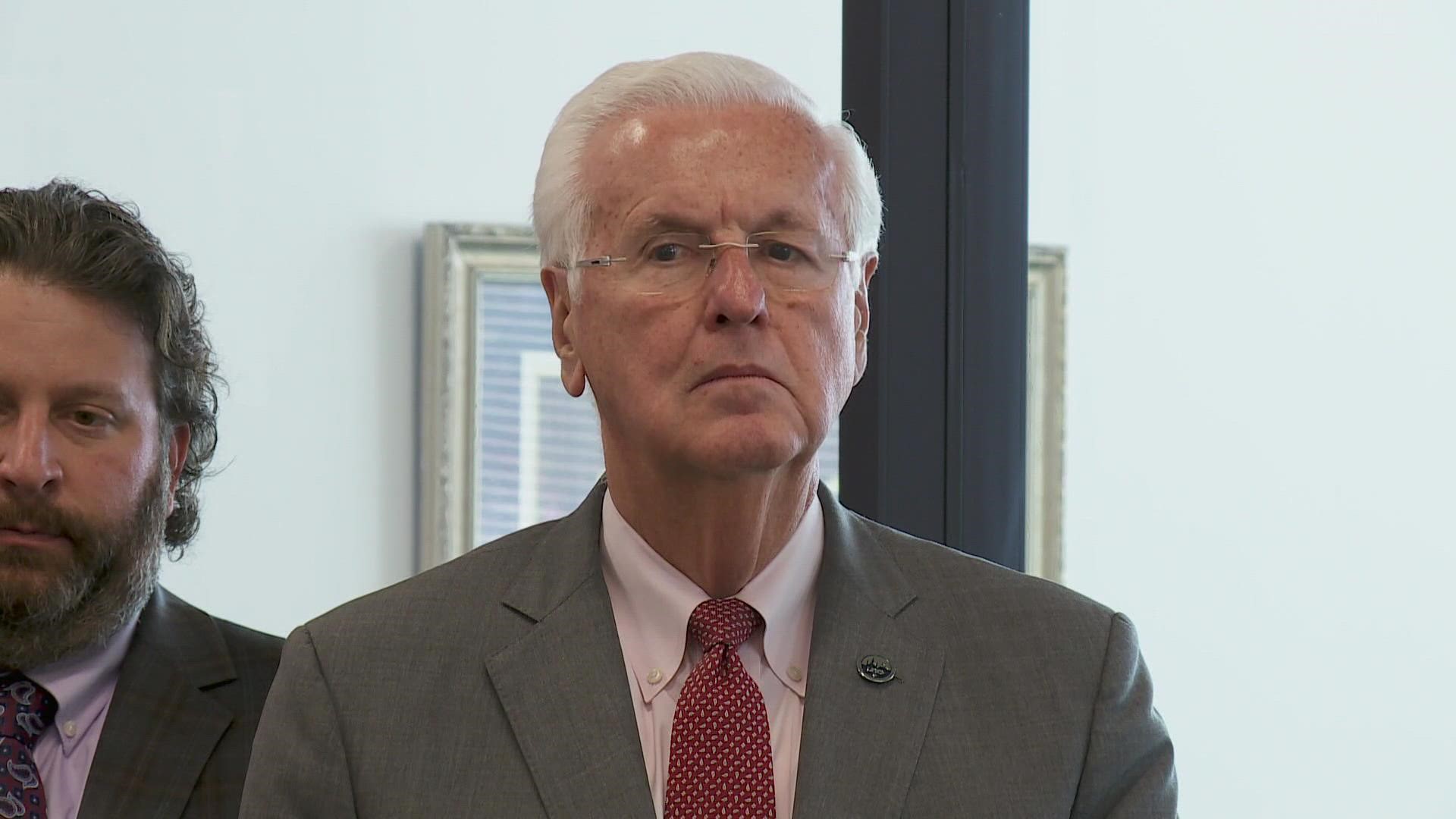

But the bill is getting strong pushback from legislators wary of more bureaucracy and from the state insurance commissioner, Jim Donelon, who says the effort is redundant. The bill was recently referred to the Appropriations Committee because it would cost $300,000 to stand up the new agency.

Donelon said his 12-person insurance fraud unit has referred 10,000 cases to state police in the last six years and is more than capable of helping law enforcement root out insurance fraud at all levels.

“Bring it on. Any fraud that you suspect, we're all ears and we're anxious to receive it and to investigate it,” Donelon said.

Donelon also argues an existing agency, the Louisiana Auto Theft and Insurance Fraud Prevention Authority, or LATIFPA, has already been conducting outreach to protect consumers against fraud. But Holl says LATIFPA has been focused too much on auto insurance issues and not on helping policyholders after storms.

Donelon said he would welcome expanding the LATIFPA board and the size of its two-person staff to better address storm fraud issues, but he’s against creating a whole new entity.

“We don't need $300,000 worth of more employees,” Donelon said. “I don't want a rival board under my supervision doing the same thing that we're already doing in my office.”

Holl said a major issue that isn’t being addressed is the role of engineers hired by insurance companies to review some of the 600,000 property damage claims filed over the last two hurricane seasons. Insurers hire engineering firms to determine if the damage pre-existed a storm.

Holl said he was inspired to propose the new legislation when he saw a WWL-TV investigation from 2017. It looked at U.S. Forensic, a Metairie-based engineering firm whose reports were being used to deny claims by homeowners after Hurricane Sandy in New York and New Jersey and after the widespread flooding in south-central Louisiana in 2016.

One WWL-TV report featured Bucky and Vivian Millet in Lake Arthur. Their insurer, Farm Bureau, hired U.S. Forensic to review their claim. U.S. Forensic’s engineer wrote a report saying the Millets’ floor damage pre-existed the 2016 flood, which photographs showed had filled the crawl space under their home with lake water.

The engineer’s report said buckling of their wood floors pre-existed the 2016 flood from a previous source of water intrusion.

“The way that engineer wrote that report, it was like he was calling us, I felt he was calling us a liar,” Vivian Millet said.

Farm Bureau eventually settled with the Millets and agreed to pay an additional $29,000 for the floor damage, Bucky Millet said last week.

But WWL-TV found previous concerns about U.S. Forensic’s practices. In 2015, The New York Times and CBS’ “60 Minutes” reported on U.S. Forensic’s role in denying a flood claim in New York after Hurricane Sandy. The homeowner in that case sued, alleging U.S. Forensic’s engineer had initially found Sandy had damaged the home, then altered the report to say the damage was pre-existing.

U.S. Magistrate Judge Gary Brown, who is now a federal district judge in the Eastern District of New York, accused U.S. Forensic of "highly improper" practices and found the firm "secretly rewrote" its initial report to make a "baseless reversal.”

But U.S. Forensic argued the changes to the report were a part of its normal, peer-review process and stands by the scientific method it uses to determine when damage occurred.

U.S. Forensic has handled thousands of claims since Sandy, but the comments by one federal judge in one case in New York continue to dog the firm. U.S. Sen. John Kennedy called out U.S. Forensic during a Senate hearing on FEMA’s National Flood Insurance Program, citing Judge Brown’s findings. But despite the judge's harsh comments, U.S. Forensic was never charged with any kind of fraud.

“U.S Forensic provides comprehensive, unbiased, and engineering-based reports to its clients,” the firm said in an emailed statement. “Each report is produced by licensed professional engineers, who adhere to the highest standard of professionalism while guided by the principles of science and engineering and adhering to the strict rules and laws set forth by the Louisiana Professional Engineering and Land Surveying Board.”