BATON ROUGE, La. — Louisiana Gov. John Bel Edwards on Sunday called for a special legislative session to address the state's property insurance crisis.

The gathering is set to begin Jan. 30 and end no later than Feb. 5.

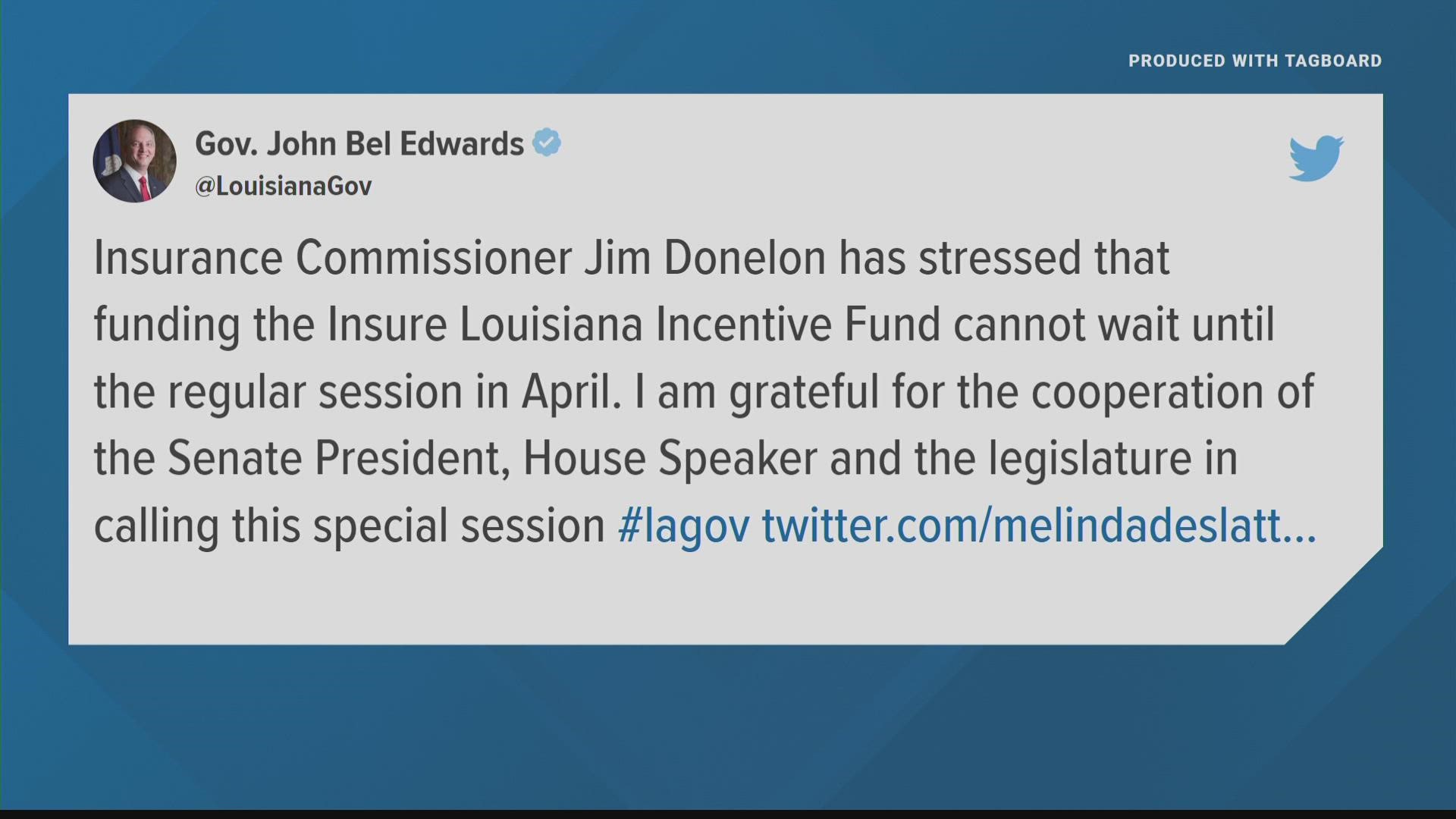

Louisiana continues to be plagued by insurance woes, with insurers leaving or going out of business in the hurricane-stricken state. Insurance Commissioner Jim Donelon wants the Legislature to allocate at least $45 million into a newly created incentive fund aimed at luring insurance firms to the state.

While lawmakers and Edwards hoped to address the situation during the regular legislative session in April, Donelon said it couldn't wait. In order to attract insurance companies to Louisiana, they would have to get reinsurance, which is coverage bought to help ensure they can pay out claims. However, companies need to get reinsurance ahead of hurricane season, which starts June 1.

“While Commissioner Donelon says we must do this now, this is just a first step in addressing Louisiana’s ongoing insurance issues after the devastating hurricane seasons of 2020 and 2021, a crisis worsened by hurricanes and wildfires in other states in 2022,” the governor said in a statement, obtained by The Advocate.

Senate President Page Cortez and House Speaker Clay Schexnayder, both Republicans, supported Edwards' decision.

“Commissioner Donelon has stated that time is of the essence with regard to the Legislature’s funding of the incentive program and thus the need to go into special session,” Cortez told The Advocate.

Following a series of damaging hurricanes in 2020 and 2021 — Delta, Laura, Zeta and Ida — more than 610,000 residential property claims were filed in Louisiana, according to Louisiana Department of Insurance data. As a result, property insurers have paid out $18.4 billion in claims as of June 30. About $11 billion of that total was paid to homeowners.

But as claims piled up, at least 11 insurance companies that wrote homeowners policies in the state have gone insolvent. Five of the firms left behind about 26,000 claims for the state’s bailout program to close out. In addition, at least a dozen other companies have withdrawn from the state, either by canceling existing policies or announcing they won’t renew them.

The situation has resulted in thousands of families paying higher premiums or moving forward without coverage.

Although Louisiana was spared from devastating storms last year, the state has seen hurricanes making landfall more frequently and leaving paths of destruction.

In addition, Hurricane Ian — although much of the damage was in Florida — is expected to have an effect on insurance outside of the Sunshine State. Many of the companies writing insurance policies in Louisiana are based in Florida, which has struggled to keep the insurance market healthy since 1992, when Hurricane Andrew flattened Homestead, wiped out some insurance carriers and left many remaining companies fearful to write or renew policies.

► Get breaking news from your neighborhood delivered directly to you by downloading the new FREE WWL-TV News app now in the IOS App Store or Google Play.