Foreclosure abuse complaints are on the rise in Louisiana and capturing more attention from jurists, lawmakers and housing advocates, who say new consumer protections are needed to bring the state in line with the rest of the country.

Orleans Parish Civil District Judge Nicole Sheppard wants to create a separate court dedicated only to foreclosure cases.

State Sens. Troy Carter and Wesley Bishop, D-New Orleans, want to change laws that have made it easier for lenders to foreclose in Louisiana than in other states.

And Andreanecia Morris, executive director of Housing NOLA, wants to raise awareness about how foreclosure abuses by lenders disproportionately hurt lower-income homeowners.

Louisiana foreclosures delayed by Katrina, Rita

They say Louisiana was buffered from much of the impact of the 2008 mortgage crisis, when millions of risky mortgage loans were sold as securities and collapsed. The national foreclosure rate hit 1 in 45 homes in 2011, but never topped 1 in a 100 in Louisiana as federal rebuilding grants and insurance proceeds flowed to homeowners after Hurricanes Katrina, Rita, Gustav and Ike.

“We were dealing with Hurricane Katrina and we didn’t have a lot of foreclosure problems and we didn’t think we were going to, initially,” Morris said. “You’ve got cases now, they’re still somewhat isolated, but this is only going to get worse.”

WWL-TV detailed some of those cases last week. One was a Marine veteran who made all his mortgage payments, thought he had addressed confusion about new fees his bank imposed but still had to fight foreclosure. Another was a man who had his mortgage transferred to a new servicing company, which tried to impose escrow fees that weren’t part of the loan he had signed.

The station immediately received dozens of calls and emails from other area homeowners who also faced foreclosure nightmares.

Foreclosure horror stories

One woman, Elisabeth Harney of Harvey, got $100,000 in insurance money to fix her house when it was damaged by Hurricane Isaac, but her mortgage servicer, Select Portfolio Servicing, would only let her and her husband have 10 percent of it and expected them to complete half of the repairs before releasing any more.

Court records show $10,000 of the insurance proceeds went to the Harneys for repairs; $30,000 went directly to lawyers who had helped the Harneys collect their insurance money in the first place; and SPS kept the remaining $59,000 in an escrow account.

That money was neither applied to the mortgage debt nor released to the Harneys for repairs. SPS argued the Harneys were doing the repair work themselves but not completing enough of it to justify releasing more of the insurance money. The Harneys sent letters contesting that, but to the wrong SPS address and the servicer claimed it didn’t receive them. They fell behind on their mortgage payments in 2013 and SPS foreclosed on them in 2015. While fighting that, Jefferson Parish tore down the house for blight in 2016.

“The sad thing is, we had the money, and they took it,” Harney said.

In March, a federal judge sided with SPS and dismissed the Harneys’ claims against the mortgage servicer.

Another homeowner who contacted WWL-TV, Chris Collins of Destrehan, said he couldn’t get his lender, Chase Home Finance, to accept his payments after his wife died suddenly, because he wasn’t listed on the mortgage documents. Collins said he scrambled for months to get all the succession paperwork he needed so he could be listed as the mortgagor, but the lender wouldn’t wait and initiated foreclosure.

Collins is still fighting the foreclosure.

“This affects not just any kind of homeowners, but homeowners who can’t hire lawyers, who can’t access legal assistance readily, who maybe find themselves in danger of missing a payment or being late, that’s who is the most vulnerable,” Morris said.

Jessie Lee is one of those homeowners who tried to fight foreclosure without an attorney, and ended up losing his home in Mid-City earlier this year.

He tried to challenge whether multiple mortgage transfers from one servicer to another had been recorded properly. He filed suit in court, claiming to be a victim of the same type of fraud that was rampant during the height of foreclosures in 2011 and detailed that year by a “60 Minutes” investigation.

That report uncovered document mills and showed big banks using forged documents to lay claim to mortgages that had bundled into mortgage-backed securities and sold to investors or transferred so many times, that clear records of who held the note did not exist.

Lee argued that when his original lender went bankrupt, other servicers used bogus signatures to claim his note, and he stopped making his monthly payment.

“I’m not going to send any money until you actually prove to me that you actually own the original note,” he said.

While trying to represent himself and stop the seizure of his property, Lee made a number of allegations that the opposing attorney called “frivolous,” “legally incorrect” and “ridiculous.”

But he said he had affidavits and other evidence the judges wouldn’t accept in Orleans Parish Civil District Court.

“I went before three different judges and everything I submitted, they denied,” Lee said.

Whether the foreclosure on Lee’s house was proper or not, he is one of many who were foreclosed upon after their mortgage note was transferred or assigned to a new servicer.

Transfers, Louisiana laws cause problems

The state senate tried to address the issue of confusing mortgage transfers in 2015, with a bill that offered basic consumer protections by requiring those transfers or assignments be filed in the public record.

Former Senator and current Baton Rouge Mayor-President Sharon Weston Broome authored that legislation, but it never made it out of committee. Instead, it was studied for three years before the Law institute produced a final report in January 2018. It called the proposed changes “unwarranted,” saying the public records are “not designed to protect” borrowers.

Morris was flabbergasted.

“Requiring that lenders take these additional steps to protect their investment and to make sure the homeowner knows who owns the mortgage on their house, this seems fairly straightforward!” she said. “It shouldn’t be an extraordinary thing, but here we sit.”

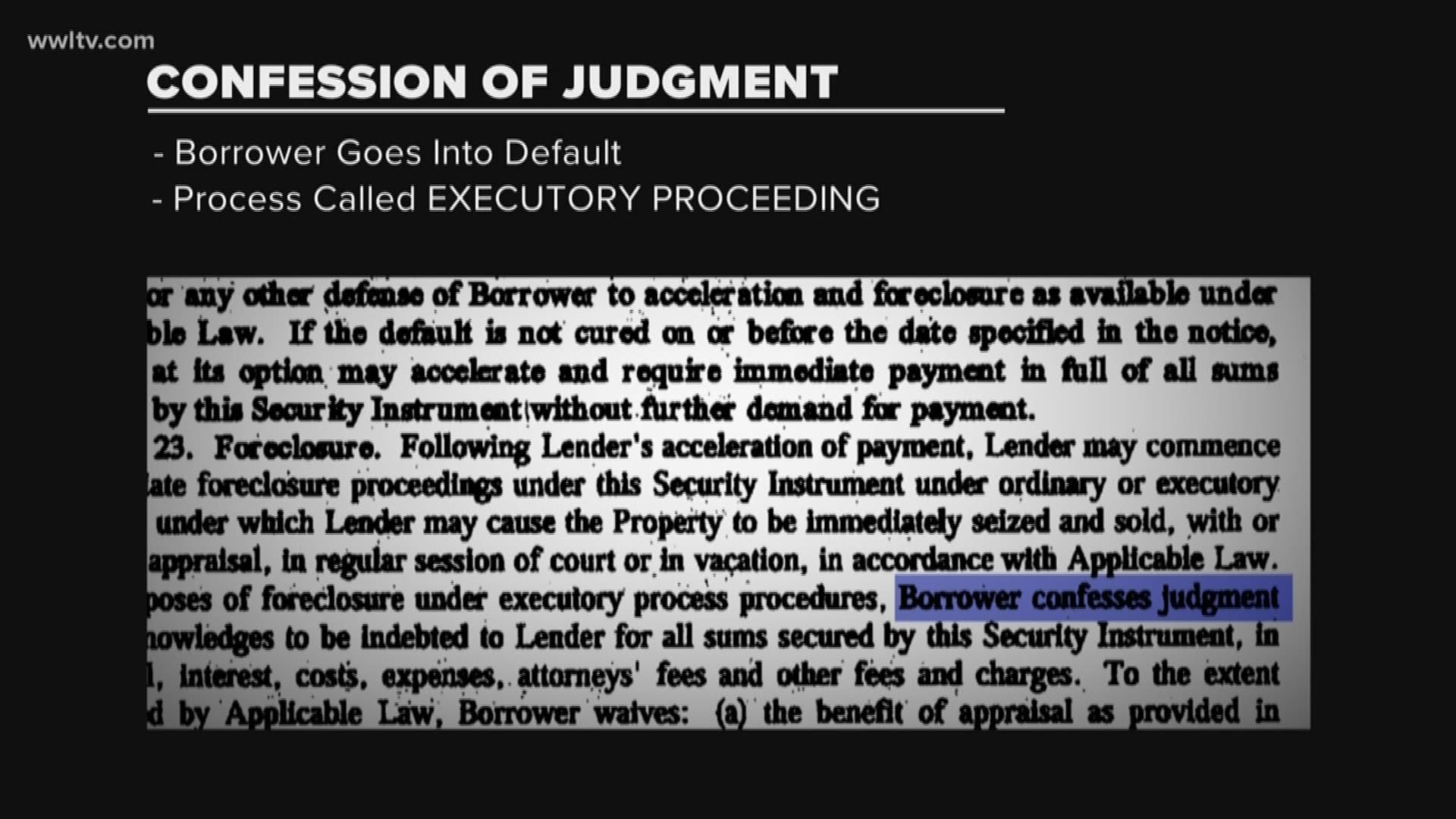

Sens. Carter and Bishop say they are looking at new fixes for Louisiana’s foreclosure laws, which foreclosure defense attorneys around the country consider unfairly slanted to lenders. In the fine print of most Louisiana mortgages, borrowers “confess to judgment” if the lender moves to foreclose by “executory process.”

That means the borrower is agreeing to let the lender fast-track foreclosure if the homeowner ever defaults on payments. Confession of judgment is banned in at least 17 states, and Louisiana also prohibits it prior to a lawsuit being filed, except in the case of foreclosures by executory judgment, a process that’s only available in Louisiana, according to the self-help legal guide Nolo.

“When people, generally speaking, sit down and sign their mortgage, they’re not reading all 26 pages of that fine print,” said Marc Michaud, a foreclosure defense attorney. “And in that fine print is completely designed to aid the bank to do whatever it is that they want to do.”

Michaud also said there’s a lack of uniformity in the civil courts. Bishop and Carter say they want to use the next legislative session to address that, possibly with a bill to create the foreclosure court Sheppard has been promoting.

“I think it’s a real problem that takes a real solution,” Bishop said.

“ If we have that foreclosure court, where people can, again, assert their rights and make sure they’re not outgunned and outmanned and that the court is going to be educating itself and examining the documents and understanding the law,” Morris said.

It’s too late for that for Lee, but he hopes the tide is turning for others.

“The judges are starting to wake up, some attorneys are getting the courage to go in and fight it,” Lee said.