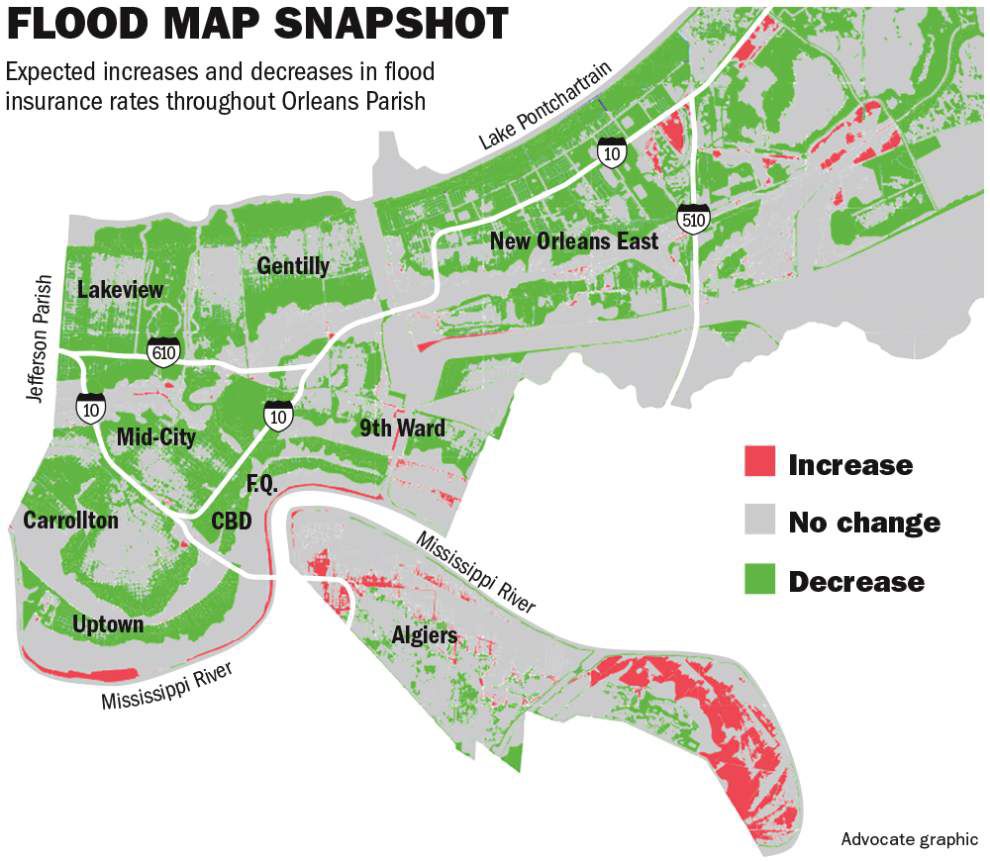

NEW ORLEANS -- New flood insurance rates go into effect Friday (Sept. 30) in New Orleans.

Flood risks change over time. When flood maps are updated, you might learn that your property‘s risk is higher or lower than before. This can affect flood insurance costs and lender requirements for insurance.

Looking for a Flood Map? Enter an address, a place, or longitude/latitude coordinates: https://msc.fema.gov/portal

How Map Changes Affect Flood Insurance:

If Maps Show ...

- Change from moderate to low flood risk (Zones B, C, or X) to high risk (Zones A, AE, AH, AO, V, or VE)

These Requirements, Options, and Savings Apply ...

- Flood insurance is mandatory. Flood insurance is federally required for most mortgage holders. Insurance costs may rise to reflect the true (or high) risk.

If Maps Show ...

- Change from high flood risk (Zones A, AE, AH, AO, V, or VE) to moderate to low risk (Zone X or Shaded X)

These Requirements, Options, and Savings Apply ...

- Flood insurance is optional but still recommended. The risk is only reduced, not removed. You can still obtain flood insurance, and at a lower rate. Even though flood insurance isn’t federally required, everyone is financially vulnerable to floods. In fact, people outside of mapped high-risk flood areas file more than 20 percent of all NFIP flood insurance claims and receive one-third of Federal disaster assistance for flooding. When it's available, disaster assistance is typically a loan that you must repay with interest.

If Maps Show ...

- Change from high flood risk (Zones A or AE) to higher flood risk (Zones V or VE), or increase in the Base Flood Elevation (BFE)

These Requirements, Options, and Savings Apply ...

- The NFIP’s Grandfather Rule allows policyholders who have built in compliance with the flood map in effect at the time of construction to lock in the earlier BFE or flood zone to calculate their insurance rate in the future. This option could result in significant savings.

If Maps Show ...

- No change in risk level

These Requirements, Options, and Savings Apply ...

- No change in insurance rates. However, this is a good time to review your coverage and ensure that your building and contents are adequately protected.

HELPFUL LINKS:

- Official site of National Flood Insurance Program: https://www.floodsmart.gov/floodsmart/

- How Map Changes Affect Flood Insurance: https://www.floodsmart.gov/floodsmart/pages/understanding_flood_maps/map_changes_flood.jsp

- Looking for a Flood Map? https://msc.fema.gov/portal